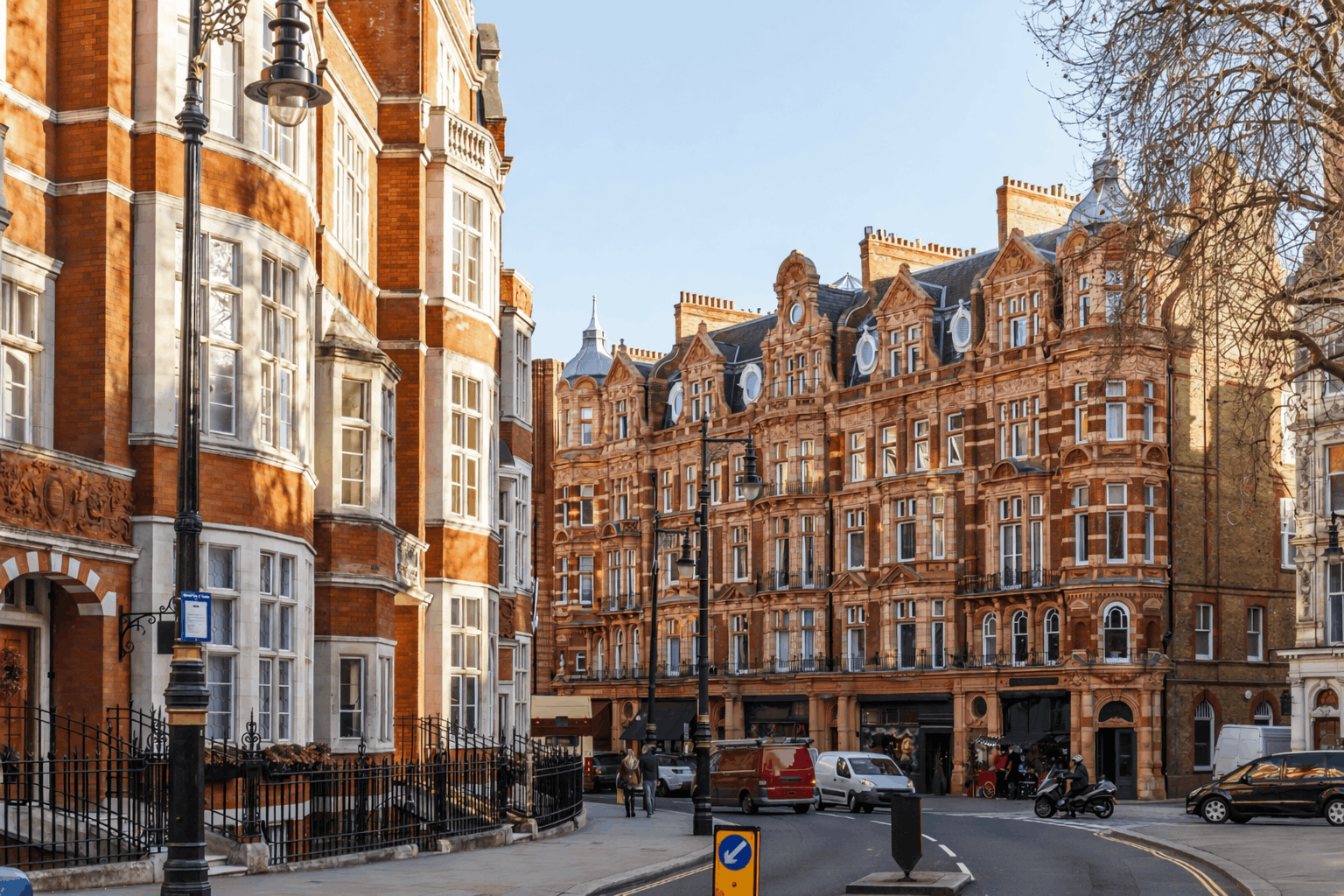

£20m Bridge Loan Delivered by Cohort Capital for High-Net-Worth Sponsor Secured Against a Mayfair Property

Cohort Capital has provided a £20 million bridge loan to a long-standing client, enabling them to refinance out of a private bank facility secured against a house in Mayfair Village. The transaction demonstrates Cohort’s ability to step in with speed and flexibility, providing high-net-worth clients with pragmatic solutions at critical moments.

The borrower, an experienced property investor with a substantial portfolio across the UK and Europe, has worked with Cohort for three years and currently has £10 million of lending with the firm on other prime residential properties. When their private bank requested redemption of an existing loan secured against the properties, Cohort was able to act decisively, structuring a bridge loan solution that kept the client’s strategy on track.

The loan is secured against a Grade II listed property which recently underwent an extensive refurbishment, with a value of approximately £56 million and over 21,200 square feet. The house is 11 bedrooms, and features leisure facilities including a swimming pool and private outdoor terrace and garden areas. Despite the property being vacant with no rental income to service the debt, Cohort took a holistic view of the borrower’s net worth, existing relationship, and proven track record. The loan-to-value of 36% provided sensible leverage against this high-quality asset.

From initial enquiry to completion, the deal was executed in just three weeks, demonstrating Cohort’s direct decision-making and ability to deliver certainty without institutional constraints.

Matt Thame, Founder of Cohort Capital, commented:

“We can move quickly because of how we’re structured, streamlined decision-making, no institutional constraints, and a practical, common-sense approach to underwriting. In this case, we completed a £20 million facility in just three weeks. Our existing relationship with this borrower provided additional comfort, but the speed and certainty we delivered are how we approach every transaction.

We’re increasingly seeing clients who need to refinance loans held with private banks due to assets under management (AUM) requirements. Where banks require borrowers to pledge significant AUM alongside their lending, Cohort provides standalone financing based purely on the property and the borrower’s capability. We have no such requirements attached to our loan offers.”

The transaction highlights Cohort Capital’s solutions-led approach for high-net-worth individuals. Unlike lenders constrained by rigid policies or cross-selling requirements, Cohort focuses purely on the property opportunity and the borrower’s capability. With direct investment committee approvals and no hidden constraints, Cohort can tailor financing structures around the borrower’s portfolio and objectives, even when assets are vacant or transitional.

This transaction reinforces Cohort Capital’s track record of supporting sophisticated borrowers in London’s competitive prime residential market, particularly when speed and certainty matter most.

— ENDS —

Editor’s Notes:

About Cohort Capital

Cohort Capital is a leading short-term real estate finance provider, offering rapid, flexible funding solutions across the UK property sector since 2019. Backed by institutional and family office capital, with over 100 years of combined investment experience, Cohort delivers tailored bridging finance solutions between £1m-£100m+ for real estate professionals.